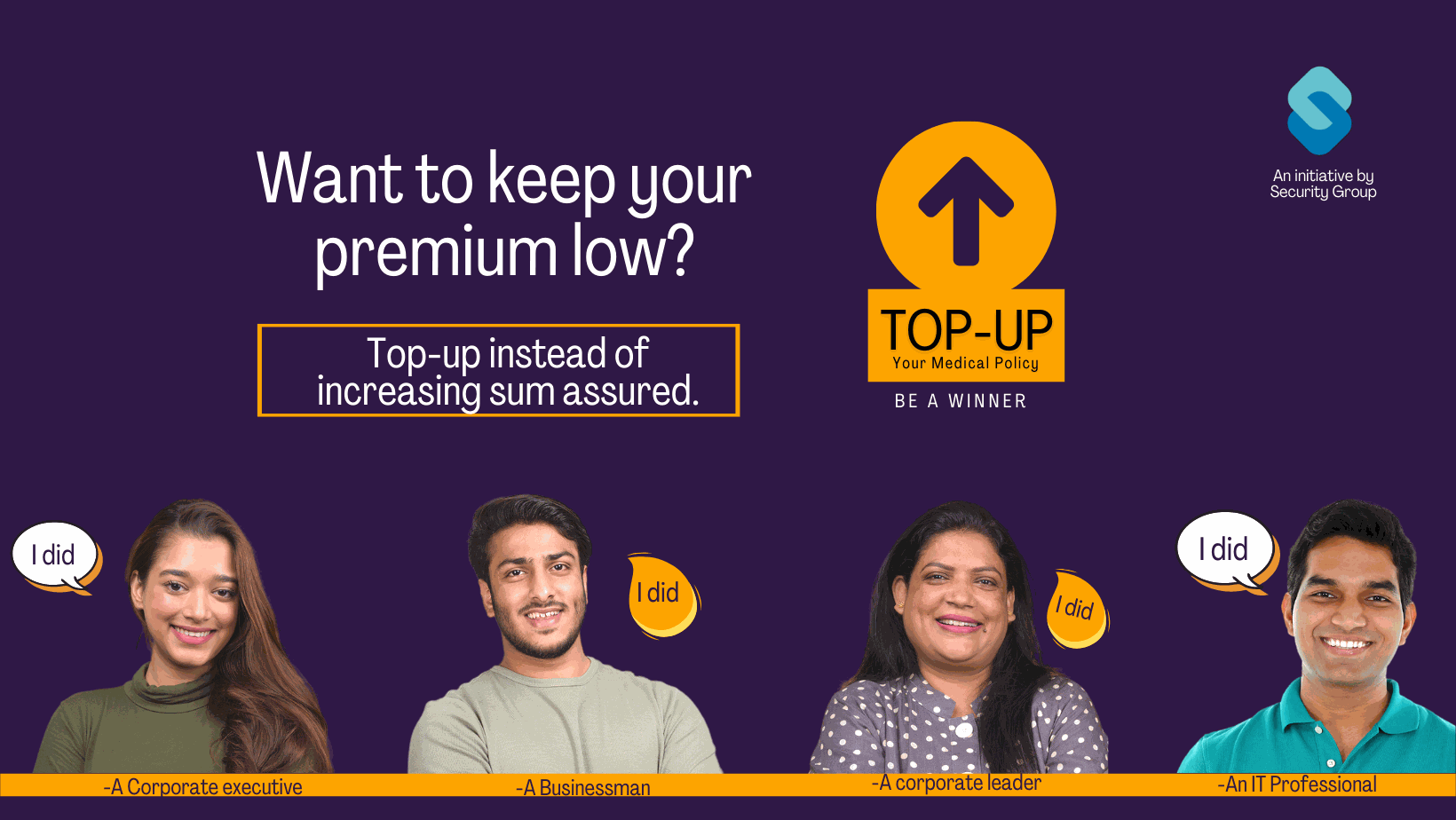

Want to increase health cover without taking on the liability of paying hefty premiums? Look at utilising the power of an option called top-up to ensure maximum health coverage for your family at a minimum cost.

Over the last few years, one big worry on everyone’s mind is: How to safeguard their family in face of any medical situation arising? The one thing that everyone is doing is to ensure they encourage themselves, and their family members, to focus on staying healthy and fit. There is also a huge focus on equipping their families with the best of medical policies, should an unfortunate situation arise.

Increase your medical coverage at minimum cost:

Post pandemic, one thing that everyone is concerned about is the sum assured component in their medical policy. After the turmoil we saw during the pandemic, and a host of long Covid cases, suddenly a cover that seemed adequate till about three years ago, doesn’t inspire much confidence any more. Hence, a sudden awareness and requirement by most people to increase their medical cover. Realising the need of the consumers, the insurance companies have brought in an option called top-up to give customers the flexibility to increase their coverage with a minimal cost impact. When you take a top-up on your medical policy, you pay a very small amount to increase your total coverage amount. The top up amount can be utilised only once you’ve exhausted your sum assured. To give you a better idea, sharing an indicative cost impact:

1. If you’re a 35-year-old, having a wife who is 32, and two kids aged 8 and 6, and have a sum assured of Rs 5 lakh through your medical policy, you can increase your sum assured to Rs. 5 lakh by topping up your policy by paying an approximate amount of Rs. 3,500 per annum. This, when your annual premium for a 5-lakh coverage would be around Rs. 24,000.

2. If you’re 45-year-old, having a wife who is 43, and two kids aged 15 and 14, and have a sum assured of Rs 10 lakh through your medical policy, you can easily increase the sum assured to Rs 10 lakh by topping up your policy by paying an approximate amount of Rs 4500 per annum. This when your annual premium for a Rs.10 lakh coverage would be around Rs. 32000.

Using top-up effective to suit your particular situation

You can use the top up tool to make yourself a winner according to your unique needs, requirements and situation. It’s a great tool that’s flexible and gives you the power to enjoy a stress-free life and focus on your professional or personal priorities without worrying about where to organise the money, if an unfortunate medical situation were to arise in your family.

To see how a the top-up option works well for different people at different stages in life, read on:

Do you feel you have a low sum assured because of cost limitations?

Mainly because of various responsibilities we have at especially the earlier stages of our professional lives, many of us are able to allocate only a limited amount towards paying a hefty medical insurance premium for our and our family’s medical coverage. A top-up ensures that you’re able to double/triple your medical coverage at a fraction of a cost. This way you’re able to ensure that your family has adequate medical coverage and at the same time you’re able to continue taking care of your other responsibilities.

Are you covered under a corporate medical policy but are not happy with the sum assured?

A lot of us are covered under our company’s group medical policy which offers a standard sum assured with no flexibility to increase our sum assured. Through the top up option, we have the option to increase the sum assured for us and our family at a fraction of the cost.

Do you have your senior citizen parents who are covered under your medical policy?

For those of us who have got our parents (who might be senior citizens) covered under our medical policy or corporate policy, the top-up is a great way to increase our medical coverage without exponentially increasing our premium paid towards the policy.

The best and the most effective way of keeping you and your family secure is to ensure you have the maximum support at the time of a crisis. Remember: Any medical situation in life becomes that much easier to go through if we have the right health plan. And, an effective way of enhancing our sum assured is Top-Up. It's a very cost-effective tool to ensure peace of mind for us, and our loved ones. Go for it, today!